Last month we reviewed what to expect in America’ s shutdown. Well, since then, a lot has happened and in my opinion, it gives us tremendous insight on forecasting he up coming Corona Virus Financial Crisis.

We Ain’t Seen Nuthin’ Yet.

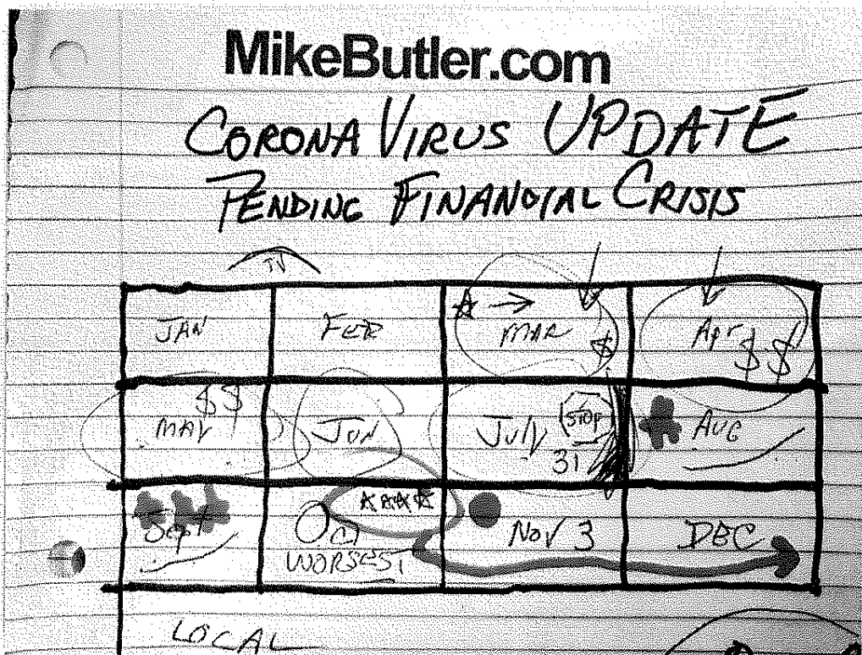

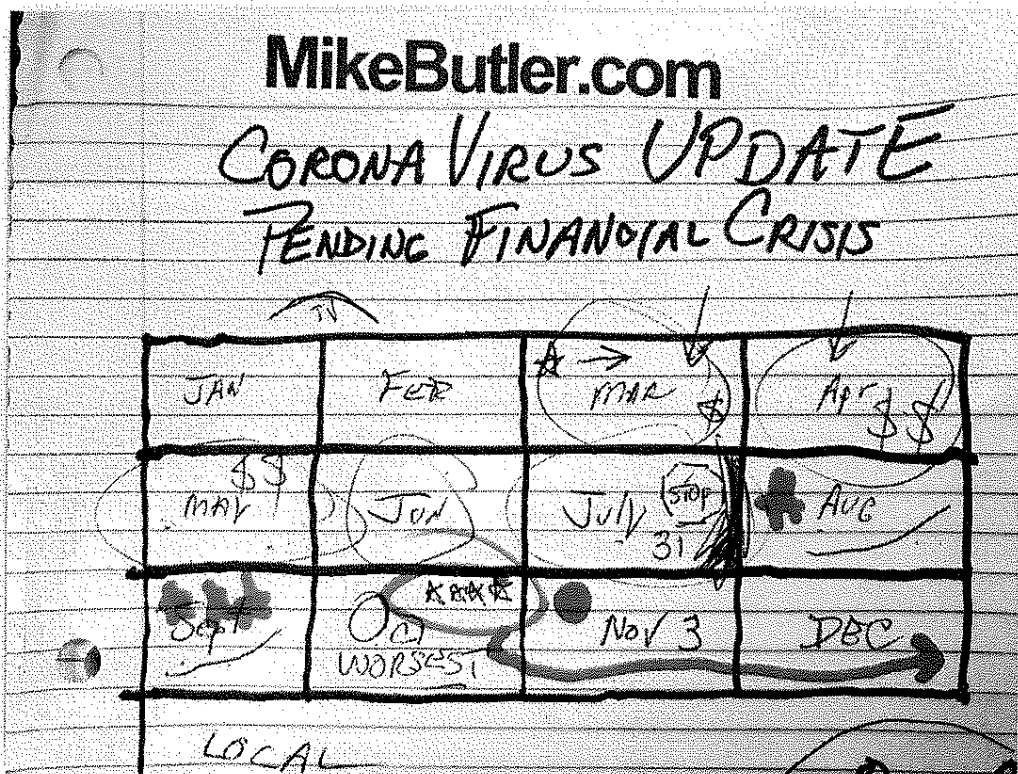

For starters, take a look at the calendar below This is a snapshot from my notebook during the Power Lunch on this subject. The calendar helps us to wrap our head around the big picture.

Right now we are in the month of May. All seems to be good right now. Many folks are riding the “Gravy Train” of free money coming in from everywhere.

Thanks to the CARE Act, folks who get unemployment are getting an additional $600 PER WEEK on top of their unemployment checks. National network news is reporting this is approximately $23 hr to sit on your butt and stay at home. Why go to work?

You might think this is great and now your tenants can pay their rent. Hold on here Bobba—Louie! Unless you are proactive in reaching out to your tenants and have great tenants, you must take a look inside their “bubble,” the world they live in. Odds are, everywhere they turn they are getting bombarded with messages from media, friends, co ~Workers, and even family members they do NOT have to pay rent. They also hear about our court system being shut down and closed. Poor old rental property owners cannot file to start the eviction process until July 15 and don’t be surprised if they bump it again to August 15.

So this puts you in a pickle. You must be pro—active and reach out in a helpful way to encourage all of your tenants to pay their rent now and why not get them to pay for an extra month or two in advance.

BACK TO THE CORONA CALENDAR

May is now. Many investors have applied and received funds from PPP and EIDL. Please read the fine print on all of your loan documents from lenders and SBA. In Louisville, the media is reporting a decrease in rental income from 25% to 33%. Nationally it’s worse. (My Rental Business is down only 3 %) Unemployment on a national level is almost 20%. This means 1 in 5 folks are unemployed. In Louisville, it is worse. Unemployment is 33% resulting in 1 in 3 people unemployed in our town. As far as your rental income is concerned, back in March, we expected April to be the worst month. Then in April we expected May to be the worst. And now in May. .. I do NOT expect June to be the worst month yet. Here’s why: When you look at the big picture, the calendar above, you will see a stop sign in the month of July. This stop sign represents when the majority of the free money runs out. Think about it. Do you really think our economy will be back to 100% at the end of July? I do not.

Okay, so August will definitely be brutal, but nothing compared to September and October. Both you and me are peanuts in this big game of our economy and for the most part, we cannot control anything. But, we can prepare and plan for the worst and hope for the best. We can take action now to survive and succeed. September will be worse than August. October will be worse than September. I’m. going to ruffle some feathers, but this is my old police detective sense gut feeling. Unfortunatelv, politics comes into play here big time.

This is all of the bad stuff. Now for some Great News! Sharp investors can see all kinds of opportunities in the up coming year. This bad stuff is not just for real estate investors alone, but it will affect homeowners and investors all across America. If you plan properly, you will be able to “Cherry Pick” some killer deals and you will have a great opportunity to turbo—charge and grow your Self Directed ROTH IRA.

So What Is A Poor RealEstate Investor To Do?

STEP 1: “PLAN” for the worse, hope for the best.

STEP 2: “WHACK EXPENSES” – Carefully review of your finnances and

whack as many expenses as you can, at least for the short term.

STEP 3: “STOCKPILE CASH” and resources to cash. You hear many folks

telling you to get HELOCS. (Home Equity Line of Credit on your home and

investment properties) Take this up to one better and find lenders who will

give you super low, fixed interest rate, for a long time, 25 or 30 years. This

is preferred because when the meltdown gets real serious, many lenders will

call your Helocs due, even if you have them maxed out. Lenders did this in

our last finnancial tsunami. Lenders are less likely to call them due on long term loans.

Sign Up for Free Investor Trainings every Tuesday at 12 noon eastern at

wwwMikeButler.com/Powerl.unch

Did you get any PPP or EIDL money? If yes, you must carefully document every

penny received to get the best benefit for your real estate business. Follow my

simple and proven system to dot every I and cross every T using the KISS method.

Stay Safe and Stay Tuned for more Corona Virus Updates for Investors.

Mike Butler is a two term Past President of KREIA, served three years on the board of National REIA, a recipient of Ed Melton Award, a property manager, a high—volume landlord. a principal in Tenant Finder Service, a retired early Louisville undercover police detective, the author of the best-selling real estate book "Landlording on Autopilot, and a natonal speaker and mentor on landlording and creative real estate investing. Contact him via his website, MikeButler.com.